banking

Uncover and Engage Optimal Depositors to Cross Sell

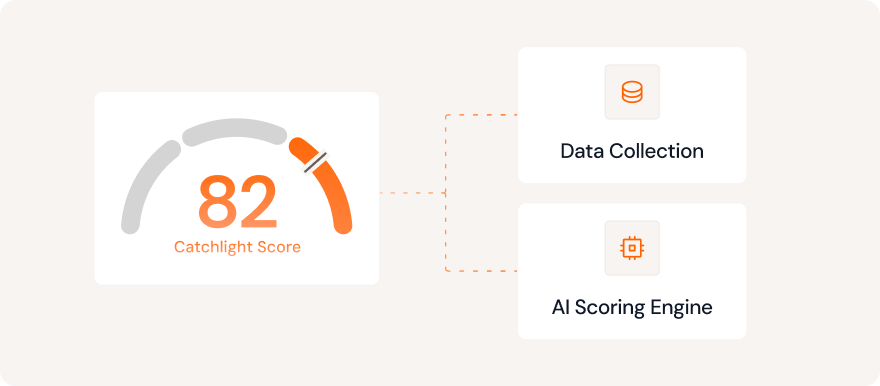

Stop guessing. Start converting. Catchlight delivers AI-powered intelligence that scores, enriches, and prioritizes your existing depositors.

Book a strategy callThe growth challenge in Banking

Catchlight’s Banking Use Cases

Some ways for banks to harness Catchlight’s AI technology to help improve their sourcing, prioritization and engagement of the highest quality leads in their pipeline.

Still Have Questions?

FAQs regarding Catchlight’s technology, pricing plans and general support

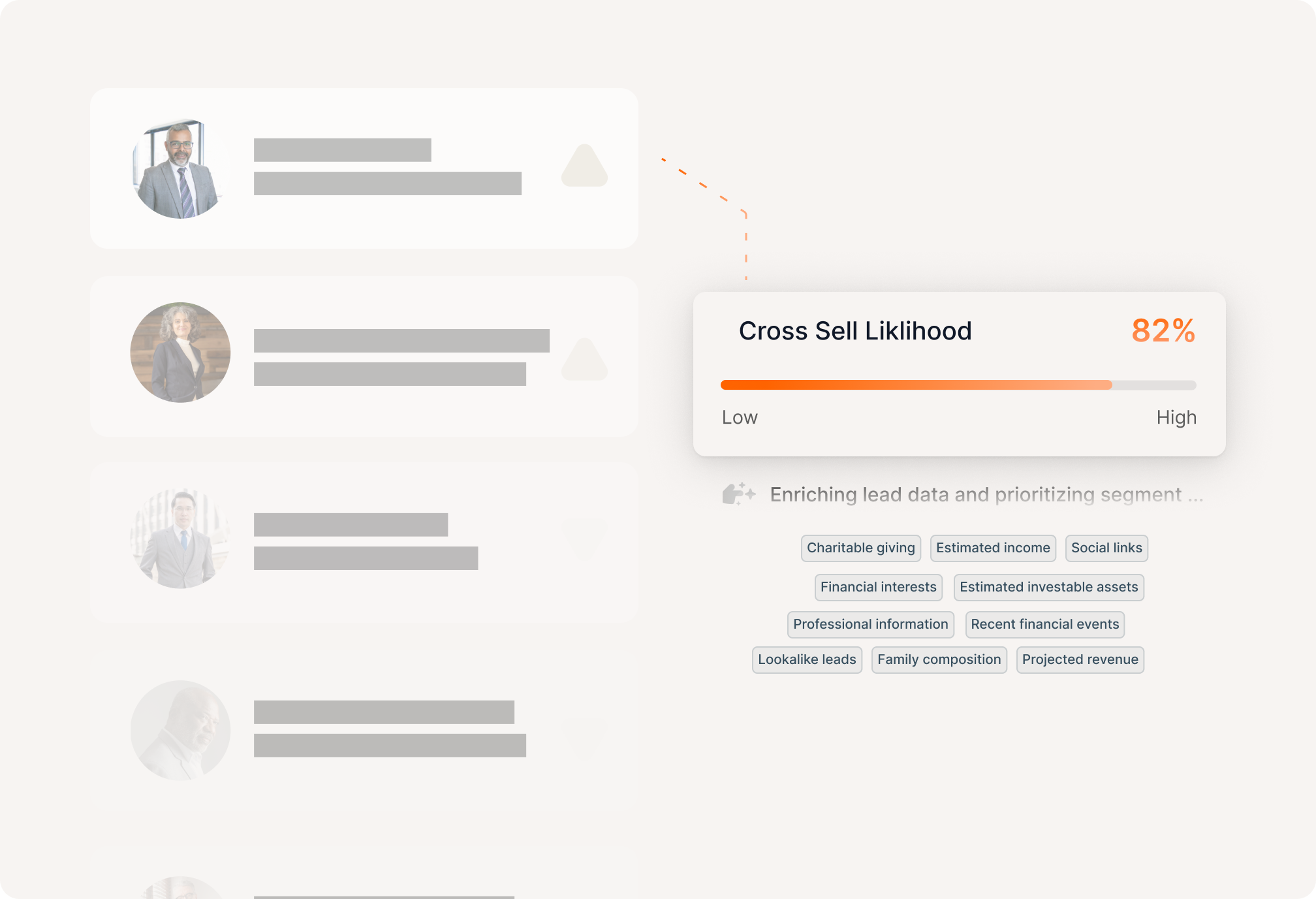

Talk to the teamCatchlight helps banks convert depositors who are most likely to become wealth management clients. It transforms customer data into actionable insights so advisors can prioritize high-value opportunities and convert faster.

Catchlight analyzes thousands of data points to uncover which depositors have the highest potential for wealth management. It surfaces these opportunities directly in your CRM, enabling bankers to act quickly and confidently.

Yes. Catchlight integrates with leading CRMs like Salesforce and offers an API for enterprise banking platforms.

Catchlight’s processes and development are built for enterprise compliance expectations, including SOC 2 Type II. We pair security with governance for custom model development and data handling.

Yes. Every customer can work with a success manager and has access to Catchlight’s experienced team members for workshops and ongoing optimization.