Catchlight FAQs

Catchlight is among the industry's first financial advice lead optimization engines and is based on actual advisor experience and artificial intelligence. Our mission at Catchlight is to help advisors effectively engage with their best-fit leads and convert these leads to clients faster.

Catchlight Insights LLC, incubated in Fidelity Labs, LLC (“Fidelity Labs”), uses AI-powered growth optimization technology to help independent financial advisors more easily prioritize and connect with prospective clients. This solution is available to advisors - agnostic to their clearing/custody provider. Advisors have told us that growing their business is a key focus area, and they’re looking for digital solutions and technology to help them do that.

Fidelity Labs is Fidelity Investments’ in-house software incubator and digital studio. Founded in 2005, Fidelity Labs has played a critical role in driving growth and innovation for the firm. Fidelity Labs has a portfolio of new businesses and are constantly prototyping concepts for new ventures.

Catchlight enables advisors to identify more easily who to focus on and how to market and pitch to leads. Think of it as an AI powered researcher for your sales efforts. We do this by leveraging publicly available data, information from data vendors, and dynamic Artificial Intelligence (“AI”) insights that improve over time. Catchlight also creates a simple workflow, akin to a smart sales notebook, to help advisors most efficiently manage their leads.

Advisors today typically have a list of 50-500 people they gathered through social connections, webinars, dinners, mailings, etc. They might pick a few to focus on in each week and will do research via Google to learn more to inform their pitch. We flip that model -- we analyze and research their entire list, identify best-fit leads using AI models, and then provide details to inform their marketing and sales. Think of it as a smart AI-based researcher who can analyze all that data and determine informed next steps. AI works great in these scenarios, as only computers can analyze that much data to detect patterns.

Catchlight helps advisors save time and effort when they want to grow their business. Big picture, the value of a new advisory client is high… we estimate an average net present value of $10K for a client with a $500K in AUM, and it can grow from there. With that much at stake, we think it is smart for advisors to invest their time as carefully as possible.

Catchlight leverages data from multiple vendors to enrich profiles, and our proprietary AI to surface insights. Sources range from first party permissioned affiliate marketing consumer insight to public records because we believe advisors must wholistically understand people they engage with to serve them better. This data could be found through search, but it would take hours for advisors that are already strapped for time.

- Create efficiency in prospecting with segment filtering and sorting by likelihood to convert AI to organize their [15 minutes of] prospecting

- Actionable data with filtering to support segmented outreach and marketing

- Engagement ideas and scoring that get smarter over time with advisor use

- Dashboards for health of overall pipeline

- Integrated into the advisor workflow (integration with Redtail and HubSpot-friendly export)

This solution is available to advisors, agnostic to their clearing/custody provider.

The current maximum for a file upload is 2,500. If you have more leads than that, feel free to upload multiple files or call us to help with a bulk upload. The number of uploads is also determined by the service model you choose. See more information here.

Easily add leads into Catchlight through our simple upload process or via our Redtail integration. Harness the power of AI and big data to quickly learn which leads to engage with and what best practices to follow.

While output may vary across leads contingent on how much data is available, expected fields include:

- financial details, including estimated assets and income,

- meta data such as occupation and age group,

- matching segments such as business owners,

- financial interests such as nearing retirement or charitable giving,

- potential life events such as a new home purchase or company stock allocation

- household engagement ideas such as sailing or grandchildren.

Only one contact detail (email, phone number, or address) is required, but the more data attributes that you enter, the more accurate the results will likely be.

While each advisor is unique, some common sources for leads include: client referrals, webinars, seminars, purchased leads, podcast subscribers, marketing sites, appreciation days, former clients, social media, and center of influence (COI) referrals.

Catchlight does not provide new leads at this time.

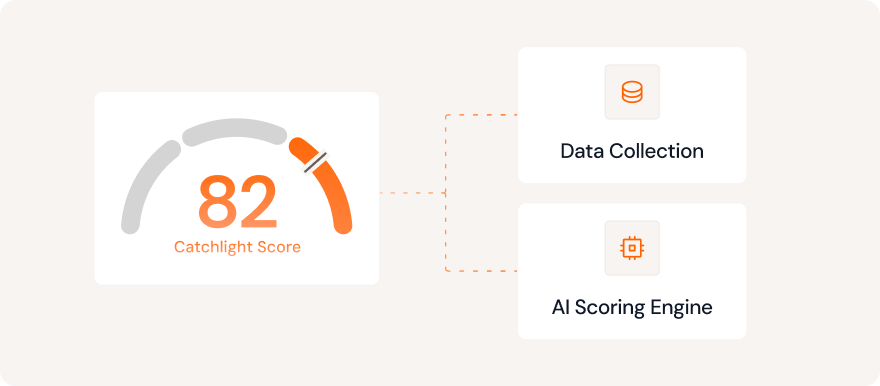

The Catchlight lead score is calculated by AI which has been trained by 100,000+ conversions from lead to client and a rich data foundation. Catchlight's predictive engine is based upon analysis of real-world outcomes from advice professionals.

This score is a prediction of how likely it is that someone may purchase financial advice. The prediction is made using AI models. These models make a prediction based upon how similar a lead is, across a number of dimensions, to a large dataset of previously converted leads. A green check mark next to the score signals high confidence in the score. When a green check mark is missing it means a significant number of the lead attributes needed for the score were missing.

Accuracy is a top priority for Catchlight. We are continuously tuning our models and working with data providers to track and improve accuracy. If you notice any inaccuracies, you are able to edit them on screen. The more details that you update and ensure are accurate, the better the Catchlight insights will be.

Your feedback is incredibly valuable to the Catchlight team. Our best new features have come from advisor suggestions. Please reach out to us at hello@catchlight.ai to provide any constructive feedback or enhancement ideas for the product.

We are integrated with Redtail CRM with more partners on the roadmap.

From within the Catchlight app, users can find recommended content from FMG intended to align with the characteristics of the prospect. A few examples include:

- The Catchlight app will show content options regarding retirement planning for prospects who fit a certain age range.

- FMG ESG content will be surfaced for prospects who are more likely to be interested in ESG products.

- Insure content specific to new parents will display for leads who may have recently welcomed a new baby into the family.

- Content on setting up a power of attorney will bubble up for prospects who may be interested in estate planning.

Catchlight added this Projected Client Revenue feature to point advisors to leads they might have overlooked if they had focused solely on a prospect’s current assets, a number of which may be next-generation investors. Projected Client Revenue is the estimated revenue an advisor may generate from a prospective client, calculated from the data-enriched profiles automatically created for an advisor’s leads.

The Projected Client Revenue calculation is unique in the marketplace for two reasons: It yields an estimated revenue range informed through a methodology developed by and leveraging Fidelity business insights; and it creates this range for a lead without the need for manual work on the advisor’s part. The result is a clear and actionable piece of information that can help guide an RIA’s growth strategy.

1026040.1.0