Unleashing Organic Growth to Drive Business Value

Organic growth can offer a multitude of benefits for wealth management firms seeking to generate long-term AUM expansion without relying on acquisitions. In fact, an effective organic growth strategy can serve as a rich foundation for driving growth in other avenues, as well. This foundation can not only deliver value to clients, but also can help firms both small and large boost their valuations.

Enjoy this preview! Access the full e-book which includes playbooks and input from industry leaders.

An over-reliance on referrals can limit the firm’s true potential for growth as other high-potential marketing activities receive less strategic emphasis.

The key is to find the right balance to nurture referrals, while also investing in other organic growth initiatives.

Unlike M&A, which can carry risks, complexities, and require specialized resources, a strong organic growth strategy can potentially generate more predictable, steady growth. And while M&A can bring instant scalability, it’s important to understand that organic growth does take time and commitment, meaning that results may be slower to materialize.

However, firms that lean into organic growth initiatives—amplifying brand and marketing, strengthening lead generation and conversion tactics, cross-selling, and investing in technology—are setting a productive framework to achieve long-term objectives. Yet the fuel needed to propel organic growth requires many ingredients. It requires time, capital, resources, and the positioning of the right people and processes.

Foundations for Growth

So, how should firms develop a robust and effective client acquisition framework? Let’s take a fictional wealth management firm we will call Ficticous Wealth Advisors Inc (FWA), through the process.

Ideal Customer Profiles, ICP's

A target customer profile that has specific financial objectives and preferences that align with the firm’s strategy and cost-effective ability to deliver an outstanding client experience.

Lead Sourcing

In a crowded and competitive landscape FWA seeks to bolster its approach to lead generation. Firstly, FWA must clearly define an ideal customer profile (ICP), one that has specific financial objectives and preferences that align with the firm’s strategy and cost-effective ability to deliver an outstanding client experience.

Once an ICP has been established, FWA launches an inbound marketing campaign. This focuses on attracting leads via targeted initiatives that address the needs of the ICP. Tactics may include robust digital marketing, search engine advertising, social media investments, where potential clients are active, as well as customized content that drives prospect engagement. FWA peppers these efforts with various lead magnets, like landing pages with calls-to-action that can help collect a prospect’s contact information.

FWA may also invest in paid lead programs – bidding on top prospects and or battling other firms in a virtual jump ball on new leads.

Lead Qualification

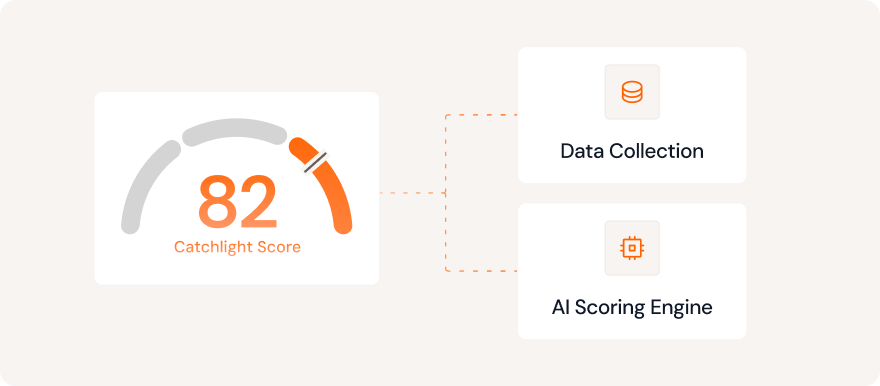

Now that FWA has sourced leads, the firm needs to harness innovative solutions to qualify them. Rather than simply distributing leads to advisors, FWA ranks its prospects to better prioritize which leads are most likely to convert. Enter: advanced analytics.

Using data analytics tools, FWA can uncover key insights about its leads—like income, assets, age, and likely life events—providing the firm with actionable intelligence. These insights help FWA identify trends and use the data to better qualify prospects, tailor content and outreach strategies, and ultimately help improve its lead sourcing.

Further, with intelligent insights, FWA may be able to segment and route leads internally to both business development campaigns and nurture campaigns. Imagine directing leads to specific business development reps or advisors based on the unique characteristics of lead and the expertise of the advisors to close them.

Lead Engagement

After FWA has identified, qualified, and scored their prospects, key data analytics are leveraged further to facilitate more personalized and engaging methods to boost conversion rates. Generative AI tools can allow FWA to use the data from its prospects to personalize emails, content, and other forms of outreach.

Additionally, data analytics and insights help inform FWA about what other services their leads may be looking for. All of which leads to the idea of “personalization at scale,” the ability to better tailor your marketing, messaging and service delivery. According to McKinsey and Company, seventy-one percent of consumers expect personalized interactions, and 76% feel frustrated when this does not happen.1 "

Finding and creating ways to send prospects valuable, useful, personalized and unique content can be critical to boosting engagement rates. Forward thinking firms are considering how they can use AI to power their content engine and match consumers with the right media. For example, sending an email to a 30 something with a newborn that speaks about the importance and strategies of 529s with a link to NYT article about it, is probably more likely to start a conversation due to its personalized nature vs. an off-the shelf, generic savings message.

Great Wealth Transfer - a Great Growth Opportunity

Timing is critical for firms positioning themselves for the future. As the Great Wealth Transfer unfolds over the coming decades, GenX and Millennials stand to inherit as much as $68 trillion from Baby Boomers, according to estimates from McKinsey. The magnitude of this wealth stands to have transformative impacts across the economy, particularly in financial services, real estate, and philanthropy.

Wealth management firms and advisors should adapt to the needs and preferences of younger generations, many of whom may favor digital interactions and different styles of investing. These generational differences could profoundly influence client acquisition strategies.

Big Picture

Establishing a clear organic growth strategy can help underpin successful outcomes in other growth paths. The process becomes a formula, making it easier to potentially forecast client growth rates and AUM growth. And unlike M&A, which requires significant time and investment and can carry risks, a strong organic growth foundation can allow for more controlled and predictable growth.

Reinforcing attention to the overall client experience, including regular communication, personalized service, and an understanding of client goals and risk tolerance, is pivotal. By building a reputable brand, leveraging technology, and maintaining strategic goals, wealth management firms can set a clear path to achieving sustainable and meaningful growth.

At the same time, there is an incredible opportunity for firms to double down on organic growth, as the lifetime value of a new client can be well into six figures, while the current cost of acquiring them is a fraction of that. According to industry veteran, Mark Hurley in his latest research, Welcome to the Jungle – The Next Phase in the Evolution of the Wealth Management Industry2, the present value of the fees from a new relationship are often 20 to 30 times greater than the marginal costs of recruiting the client; and as a result, “There is an opportunity for participants to build gigantic amounts of incremental enterprise value,” he states.

Be sure to follow us and join the conversation on our LinkedIn page!

[1]https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/the-value-of-getting-personalization-right-or-wrong-is-multiplying>

[2]https://static1.squarespace.com/static/63d44b39cc31ac17cb99b0ce/t/658202887f27f741d473681b/1703019144561/DPP-WelcometotheJungle_Dec18Reg.pdf