Check out this exclusive preview! Access the full e-book to discover comprehensive strategies and expert insights from leaders in the industry.

Optimize Your Referability – Turning Your Client Base into Your Best Salespeople

For growth-minded firms, client referrals can serve as a key element in a growth blueprint. After all, when firms turn to M&A to boost AUM and expand market presence, it does not guarantee client referrals.

Client referrals in the wealth management space are, in many ways, the ultimate reward—a reflection of satisfaction, trust, and credibility. Firms may view referrals as testament to all their hard work in making clients happy. In fact, one could argue that the independent RIA industry was built on referrals as most firms lack the $100 million-dollar+ marketing budgets of the big Wall St. brands and have instead let their client focus and fiduciary business models be their calling card for differentiating in a crowded marketplace – all of which has resulted in RIAs being the fastest growing segment for the last decade1.

According to research from Cerulli2, 53% of new business for advisors originates from referrals from clients, friends and family – by far the number one source of organic growth. As a result, advisors could optimize this rich channel by investing in process and technology to harvest these valuable, hard-earned opportunities. At the same time, an over-reliance on referrals can limit the firm’s true potential for growth as other high-potential marketing activities receive less strategic emphasis. The key is to find the right balance to nurture referrals, while also investing in other organic growth initiatives.

According to research from Cerulli2, 53% of new business for advisors originates from referrals from clients, friends and family – by far the number one source of organic growth. As a result, advisors could optimize this rich channel by investing in process and technology to harvest these valuable, hard-earned opportunities. At the same time, an over-reliance on referrals can limit the firm’s true potential for growth as other high-potential marketing activities receive less strategic emphasis. The key is to find the right balance to nurture referrals, while also investing in other organic growth initiatives.

Referrals can emerge from various sources. Tapping into client networks can be one method of finding leads who may have specific financial objectives and preferences that align with a firm’s strategy. While existing clients are often the primary source of referrals, professional networks and events can also be productive avenues.

Referral Strategies

Delivering a high quality of service and maintaining strong client relationships are significant factors in generating referrals, but a solid marketing plan may also help jumpstart referrals. For prospects wishing to learn more about a firm, robust educational outreach and communication about investment strategies, services, and performance can be a way to showcase expertise and value.

Centers of Influence (COIs), such as attorneys, certified public accountants (CPAs), tax professionals, real estate agents, and other professionals can also play an important role in the referral process.

These entities can be trusted advisors in their respective fields and often have established relationships with clients who may be seeking financial advice and management. Here's an overview of how COIs can contribute to the referral process:

CIOs typically have established trust and credibility with their clients due to their expertise and track record in their respective industries. Clients often rely on their recommendations and referrals when seeking additional services such as wealth management. According to the latest Fidelity benchmarking study3, COI referrals represent nearly 20% of new clients for $1 billion+ firms, a significant source; and provide even further rationale for why firms should also invest in process and technology to optimize and grow these COI flows.

As a result, it’s a good idea to make sure your COIs know what your ideal client looks like: age, occupation, asset requirements, etc. Educating them as to these key aspects can go a long way to improving volumes, success rates and ultimately building more COI relationships.

While limited in access, firms may find success through referral networks such as those offered by custodians.

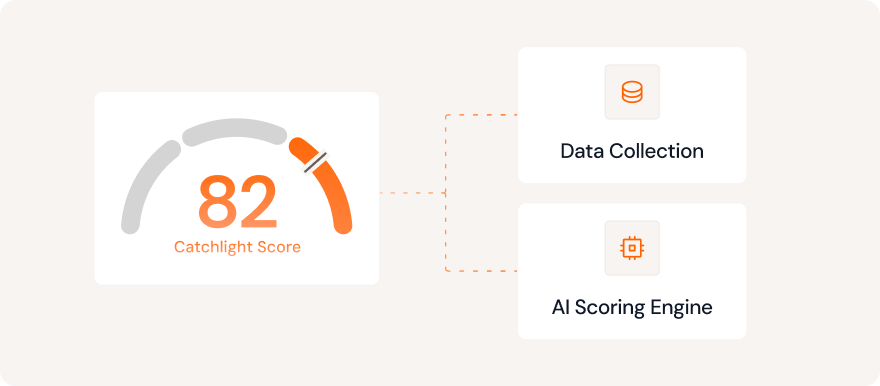

Leveraging data can also act as a key factor. Firms can implement technology to monitor the origin of referrals, developing an understanding of how they emerge and measure the success rate of converting referrals into clients. AI and machine learning can also be leveraged by firms seeking an edge. Data analytics can enable firms to identify the prospects with the highest potential to become clients, allowing them to concentrate their resources on these likely candidates.

Limitations of Referrals

While referrals are an excellent source of new business, it is important to keep in mind that the flow of client referrals can often be unpredictable and sporadic. Firms can be committed to the legwork, but there are limits to the resources, time, and energy that should be focused on seeking client referrals. At the end of the day, there are more prospects in the market outside of client networks. This suggests that firms should take a diversified approach to generating and converting leads.

For example, firms relying primarily on advisor-driven growth and referrals may face scalability obstacles. At the Wealth Management EDGE conference last year, Michael Kitces, co-founder of XYPN, said that his analysis showed that the most successful firms in terms of growth are those that do not primarily rely on client referrals for new business. This is because as firms grow, relying on advisors for marketing and client referrals becomes less efficient, Kitces noted, highlighting that advisors become more expensive over time and less effective in business development roles.

As advisors engage in client development, a significant part of their compensation becomes marketing spend, Kitces said. He made the point that marketing is the one of the most scalable aspects of an RIA business, but relying on referrals and advisor-led marketing is not a scalable strategy.

Practical Steps

Many firms work hard for their clients and in the end are rewarded with referrals, but as Kitces points out, operationalizing that work for more seasoned advisors may prove to be unprofitable over the long term. Firms can put programs in place to capture referrals both from existing clients and COIs and should measure the impact of their programs to double down where possible.

From an organic growth perspective, they should also be eyes wide open about how much time and resources are allocated for referrals. Set a goal for % of growth to attribute to referrals. Run programs for 12 months to see how well you do. Tweak the plans as you go. Know that given the lack of predictability, a firm should not just rely on referrals to hit their growth goals. A more pragmatic approach is to build programs that drive directly at those goals and look at referrals as the icing on the cake.

Be sure to follow us and join the conversation on our LinkedIn page!

[1]https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/the-value-of-getting-personalization-right-or-wrong-is-multiplying>

[2]https://static1.squarespace.com/static/63d44b39cc31ac17cb99b0ce/t/658202887f27f741d473681b/1703019144561/DPP-WelcometotheJungle_Dec18Reg.pdf

[3]https://19539371.fs1.hubspotusercontent-na1.net/hubfs/19539371/2023%20RIA%20Benchmarking%20-%20Fidelity.pdf