Take a look at this sneak peek! Get the complete e-book featuring strategies and insights from industry experts.

This growth strategy could be limited to those firms who have an existing base of clients in an adjacent business. However, there are firms who have acquired adjacent businesses, or are partnering with a turnkey retirement platform, as part of a strategy to target new potential clients with retirement and wealth management services. Or, perhaps firms could look to build deep partnerships across the financial services sector to opportunistically cross sell their services.

A growing trend in the industry is for accounting firms to expand and integrate wealth management professionals and broader service offerings for their clients, particularly as the process of tax preparation can identify financial and investment planning opportunities. For example, a client who is in a high tax income bracket may have fixed income investments that are contributing to a higher tax bill, when the opportunity to replace those with tax-free municipal bonds can significantly lower their tax liabilities. In these types of cases, being able to refer the client to their wealth management department creates a substantial cross-over opportunity.

At the same time, many wealth management firms are bringing CPAs in-house to be able to provide a holistic approach, which can result in incremental tax preparation and planning revenues. Similarly, wealth management firms are hiring dedicated estate planning attorneys to be able to also help clients plan for the smooth distribution of their estates. This integrated strategy helps identify the need and opportunity for advanced strategies, such as charitable giving vehicles, insurance trusts, and similar, that can also create cross-over revenue opportunities. Ultimately, this full-service approach of bringing accounting and legal services in-house provides firms with a compelling marketing message that they can provide a complete, “family office” solution to meet all aspects of higher net worth clients’ professional service needs.

For firms not looking to increase their overhead costs with additional expensive professionals, such as accountants and lawyers, many are entering into referral agreements with local CPA and Legal firms to capture incremental revenues and grow through this type of cross-over arrangement. Due to the complex regulatory environment surrounding referral agreements, there are significant disclosure requirements needed, so firms looking to go this route should plan accordingly.

Along these lines, many regional banks are also looking to leverage their customer relationships to uncover cross-over opportunities as well, and are integrating financial planning and investment management into their service mix. By leveraging and mining key customer data, they can identify opportunities to offer wealth services, creating new organic growth streams.

Key considerations for cross over

![]() Use intelligent segmentation for targeting

Use intelligent segmentation for targeting

By segmenting your client base based on factors such as business owners, demographics, financial positions / investable assets, income, and current products/services they utilize, you can get a better understanding of who might be an ideal prospect and who you may want to nurture for a future cross sell. Leverage data and insights to better understand their needs, preferences, and pain points. Clients with significant assets or those approaching retirement may be prime candidates for wealth management services.

Particularly for business owner clients, they most likely have some form of a company retirement plan that can benefit from the fiduciary advice models of independent RIAs. Additionally, because many of these businesses are small, the big retirement players do not focus on this segment, leaving it vastly underserved, creating an attractive growth opportunity. Combined with new, low-cost, turnkey retirement plan services from custodians and TPAs, RIAs are well positioned to become a go to solution in the small plan marketplace.

![]() Client/Prospect Education

Client/Prospect Education

Once you have onboarded a few retirement plans, consider the services you offer and how helping to educate those plan participants and their business-owner plan sponsors about the benefits of wealth management services, including wealth preservation, tax optimization, and estate planning could be key to generating interest. Firms can develop targeted communication strategies, based on intelligent segmentation, including newsletters, seminars, webinars, and one-on-one consultations, to articulate the value proposition of wealth management. Particularly for soon-to-be retiring baby boomers, developing retirement income planning advice and corresponding education positions advisors to be front and center when the decision to rollover occurs.

![]() Personalizing recommendations

Personalizing recommendations

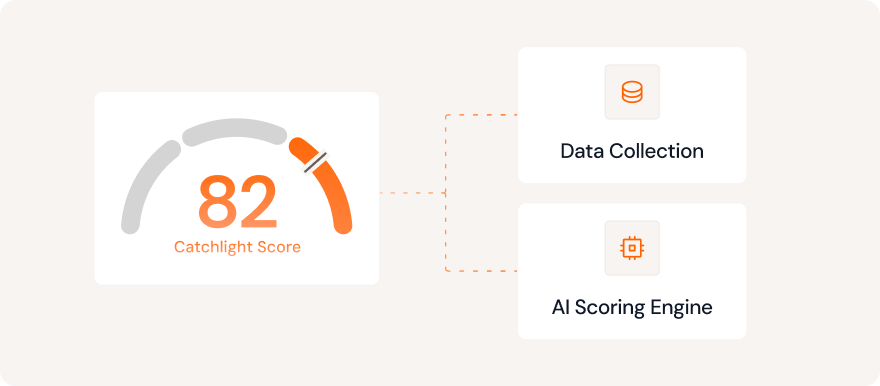

Leverage data analytics and client insights to personalize recommendations for wealth management services based on each client's financial profile and life stage. Tailor your offerings to meet their specific needs and goals, demonstrating your commitment to their financial well-being. Deploying the latest financial planning platforms and their ability to customize and automate access to basic financial plans and retirement analyses for retirement plan participants, enables you to gain scale in deploying personalized solutions integrated with that company’s specific benefit plans, further cementing these relationships and keeping you top of mind for rollover opportunities.

Conclusion

Crossover as a growth strategy may be limited to those firms who have existing clients in adjacent businesses, or those with the capital to acquire such businesses. However, with new product and technology innovation, advisors can leverage turnkey retirement plan platforms to enter the retirement plan marketplace, particularly in the small plan market which has been underserved. As a result, these opportunities can provide a firm with a pool of high-quality prospects, and if combined with strong data and insights can help accelerate growth. At the same time, broadening service offerings to provide accounting and estate planning capabilities also provide compelling cross-over opportunities.

Be sure to follow us and join the conversation on our LinkedIn page!