Financial Advisor Marketing requires a delicate balance between client retention activities and new customer acquisition strategies.

In part one of this two-part series, we explored traditional financial advisor marketing tactics that deliver highly personalized and customized experiences. Their success hinges on focus. First, focus on the prospects most likely to become clients. And second, focus on content topics closely aligned with their specific goals and interests.

This article, part two, shares online marketing strategies that can generate strong results without breaking the bank.

Financial Advisor Marketing Strategies —Traditional and Online Approaches

While the world has become increasingly familiar with virtual business relationships, personal trust remains essential when selecting a financial advisor. Compared to 50 years ago, potential clients can do much more of their research online before retaining a wealth manager. While a modern financial advisor can reach prospects through many channels, you must choose wisely; more channels require more time, attention, and budget.

Traditional Advisor Marketing Strategies

Financial advisors have a long tradition of generating new business through offline channels. These include direct mail, cold calling, meeting prospects through local clubs and organizations, networking groups, referrals and more.

Part One of this financial advisor marketing series highlighted four ideas that can help you prioritize your leads, segment your clients and leads, and create highly personalized seminars, webinars, and lifestyle experiences for clients. These approaches are essential in building trust and creating new wealth management relationships.

Your best clients may be your competitors’ best prospects. And your hottest prospects may already have a trusted advisor. The financial advisor who knows their prospects best is more likely to win. Financial seminars enable your clients and prospects to see your expertise firsthand. For example, your prioritized client and prospect lists may each have 15 people who are future inheritors with teenagers. Your prospects may appreciate a highly targeted seminar topic, e.g., “Optimizing Your Portfolio for Inheritance and College Financial Aid.”

Or you can hold appreciation events that resonate with your top clients. Golf, fishing, concerts, you name it. With the right client insights in hand — i.e., their interests and hobbies, you are more likely to create memorable experiences and lasting connections. Click on the link below to find out how you can learn more about your clients and prospects

Online Financial Advisor Marketing Strategies

Online marketing can be a full-time job in any industry, including wealth advisory. But Registered Investment Advisors (RIAs) are not necessarily online marketing experts.

Yet, RIAs must manage a myriad of online marketing tactics, including website management, blogging, email marketing, social media, and digital advertising, to name a few. These require skills and knowledge, including copywriting, search engine optimization, direct marketing, a/b testing, and web design.

While it’s important to be digitally savvy, our suggestions strive to deliver the potential for solid results without demanding a full-time digital marketer.

Marketing Strategies That Work — Upgrade Online Marketing Content

See marketing strategies #1 to #4 in part one of this Financial Advisor Marketing series.

Financial Advisor Marketing Strategy #5 — Website Updating and Personalization

Websites are expensive to create and maintain — time, review cycles, and design resources add up. Ideally, your site includes information about your clients’ most burning needs. Of your current clients, what is the most common goal or concern? What common circumstances do your prospects share? Keep these in mind as you update your site.

Your new content should support the marketing ideas that follow. You want that content to appeal to the maximum number of prospects. The critical question you’ll need to ask yourself is, “how will I find out which prospects and clients share which concerns”?

Your website should always be correct and up to date. Consider reviewing it semi-annually.

- Search Engine Optimization. When your page content changes, Google re-indexes the page and may (or may not) rank it higher. In general, change is good.

- Content changes. You may be surprised how much of what was true a year ago isn't as accurate today. You may have new expertise, new opinions, or new ways of wording old things.

- Error checks. Bring an editor along to catch the minor errors that could tell potential clients you lack attention to detail.

- Dated content. Update marketing content, such as an 'upcoming webinar' that has already occurred.

- Add critical strengths and highlight your most essential differentiators. Stand out from the crowd. For example, if you’re a fiduciary, include that information on your home page’s main banner area.

Take a step back and read your site as if you are a first-time visitor. Suppose your new visitors understand what you do and your areas of specialization and expertise. In that case, you are at a good starting point.

Learn More About Your Prospects

Strategy #6 — Financial Advisor Marketing Materials

Some prospects will read every word of your printed and online materials. Others see the look and feel of your downloadable marketing materials as a reflection of your service quality. Regardless, they are one more touchpoint that can build trust.

Pick just one pain point for a new downloadable or printed fact sheet refresh. What topic? See part 1 of this Financial Advisor Marketing series. Use your intimate customer knowledge to identify your clients’ and prospects’ most significant financial concerns. If you're already planning a seminar, you can update or create new materials to leave with clients and prospects. Ideally, you can find a new topic or angle for your new fact sheet.

Since you are aiming for more custom content, this piece may be a deeper dive than your other materials. Using the financial seminars example above – you can create a presentation for parents of pre-college teenagers expecting an inheritance. Your materials can further build your brand with prospects and clients as experts in the field.

Strategy #7 — Video Marketing Using Pre-written Content

You can take your presentation from strategy #6, create video content for online platforms such as YouTube, and share it across your website, social media, email, and more.

Record the session and save it for future use if you plan to present it as a webinar.

Adding video content will help your SEO and increase your site engagement, even if the video is hosted on YouTube. Video can also help increase your social engagement. With the research and writing for a seminar already done, the video recording should be relatively fast with better potential to provide a higher return. Video can help build trust and engagement, and ultimately attract and retain more clients.

Strategy #8 — Social Media Marketing Strategy

Your social media presence can be a big difference-maker. Your social accounts can give your clients social proof of your expertise and integrity in several ways. First, your content and comments could be looked at as a direct reflection of your expertise. Second, comments from your followers can serve as even further social proof.

Like every other marketing channel, social media can be a full-time job. So, it’s important to understand the channels and reach. It’s common to review social media engagement statistics as well as website stats to see where and with whom your content is resonating. By tracking engagement, you may be able to determine where your better prospects are coming from and what they may want to hear from you.

As mentioned above, video content can capture higher engagement than text. See marketing strategy #7 and use the video you’ve created from your webinar for social media. You can chop the video into brief, 90-second segments and use them in social posts. One goal is to gain brand impressions from your clients, followers, and prospects. This way, your audience gains exposure to your expertise and name over time.

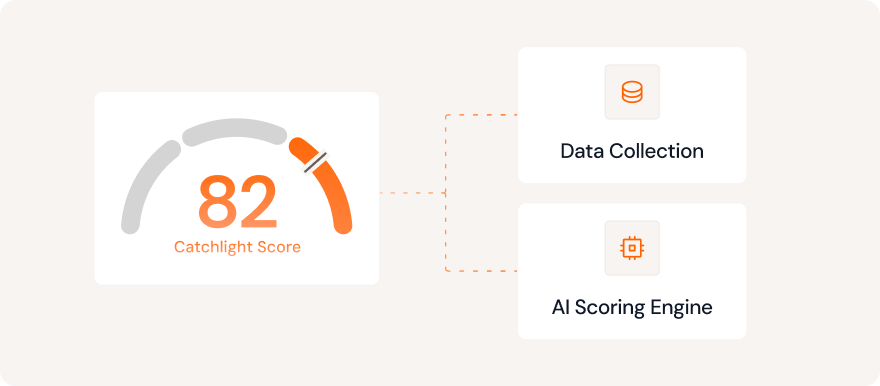

The second is to provide tangible value. Ideally, your webinar and video content help your clients and prospects identify real needs and gaps you can help fill. Of course, their call to action is to reach you. By selecting the ideal topics for your audiences, you’re more likely to attract larger audiences and convert new business. One way to learn more about your customers is using artificial intelligence for financial advisors to score and prioritize your leads. Next, find common financial concerns or life events for your content focus.

Put Your Marketing Plans to Work Today

The core foundation of your marketing is knowing your clients and prospects better than your competitors do. You can make deep connections with your marketing if you have a clear and deep view of your prospects’ financial needs and life goals. Getting started is easy.

Set up a meeting with our team today and discover how Catchlight can help your practice grow.

1059983.1.0