We’ve all been there. We send an email to prospects whose click-through and appointment-setting rates were among the best. But conversion rates are horrible. The messaging was especially attractive to the wrong people — those less likely to become clients. Or, that killer subject line delivers a 45% open rate but the message fails to deliver even a single click.

This post takes a deep dive on ways to deliver the right message to the right prospect to increase your business development outcomes.

For any effort that does not deliver, you should always ask yourself what went wrong?

- Did it target the wrong prospects?

- Did the content “land.” Were readers interested in the topic and email content?

- Was the call to action clear and engaging?

- Did we have the right message but the wrong delivery method? I.e., email instead of a webinar.

- Were the KPIs not aligned with expectations?

Sometimes your prospect stops paying attention after five minutes if you haven’t already gained their trust. You can let your prospect lead the discussion toward their main concerns in a one-on-one conversation. But that’s hard to achieve with a one-way email, social post, or presentation.

The problem: ROI on your marketing effort is falling flat and you are not sure how to drive increased engagement.

The solution: Crafting personalized messaging for your top client and prospect segments has strong potential to drive higher engagement and conversion.

Financial Advisor Messaging — Define Your Ideal Prospects

The definition of “best” prospects isn’t the same for every RIA. One of the most important things you can do to grow your practice is to have a clear perspective and description of your best clients and what they have in common. Where do your areas of expertise overlap with your prospects' most pressing needs?

When speaking with financial advisors, they often cite AUM as the most important growth metric. Many advisors tell us that assets from new clients are the most important form of AUM growth.

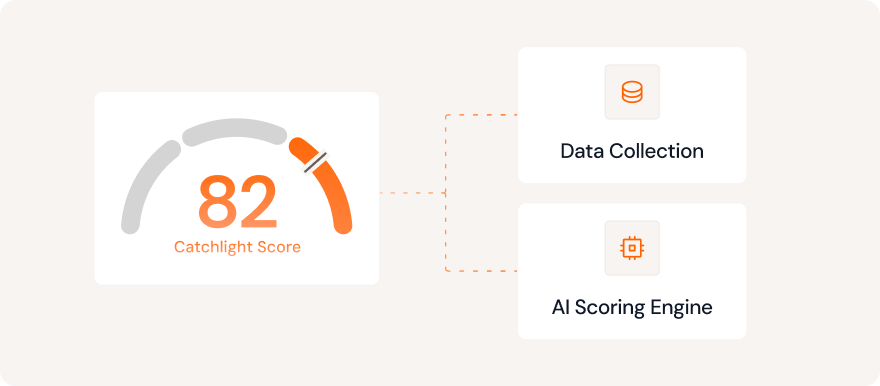

You can create segments of your prospects by opportunity potential, based not just on AUM but also on their Catchlight Score – which is designed to measure their likelihood to convert to paid financial advice.

|

AUM |

Catchlight Score |

Opportunity |

Risk |

|

High |

High |

Star accounts – retain and grow Higher propensity to increase AUM |

Your competitors’ top prospects |

|

High |

Low |

High AUM despite a low score Lower propensity to increase AUM |

Lower score may indicate longer lead time and higher churn risk |

|

Low |

High |

Higher opportunity accounts Potential to increase share of wallet |

Lower risk of attrition |

|

Low |

Low |

Lower opportunity Consider including them in digital marketing |

Limited risk other than ROI on time spent |

It’s important to consider what your best clients have in common, aside from high AUM, and use that insight to guide how you think about which prospects will drive future growth. Let their mutual interests guide your outreach topics and messaging. Using segmentation can make it easier to organize your customer and prospect lists by interests so that you can send targeted messages to the right people.

Segment Your Clients and Prospects Further

There’s so much more to your clients than you can see in an account statement. Segmentation characteristics can span behavioral, psychographic, demographic, and geographic. And remember, lives change. Segmenting by life events (new child, new home purchase, pending retirement, selling a business) is another way to deliver compelling information to a group that may be experiencing the same life event.

You can create higher-impact messaging when you understand the shared characteristics among prospects with similar needs. Segment your prospects based on their life stages, financial needs, and lifestyles as a first step.

Efforts can be futile without accurate data. Fortunately, financial advisor lead services that were previously too expensive today for most financial advisors are available today. With accurate, deep client data, you can create powerful segmentation.

Learn More About Your Clients and Prospects

Create prospect segments by life stage and lifestyle

Financial advisor marketing strategies have long targeted newlyweds, new parents, and others based on their life stages or events. While the concept of life stage targeting isn’t new, there seem to be more and more vendors trying to sell data. The challenge is that without the proper filtering and analytics methodologies, one could very quickly spend a large budget and not have much to show for it. More data doesn’t always solve a problem, but the ability to map data to your prospects and clients and segment based on unique characteristics will set you apart.

The more data you have, the more potential common characteristics you can find. For example:

- Demographic data, such as age, assets, income, children, and occupation

- Life event info, such as having a new teen driver, planning to retire this year, or receiving company stock

- Lifestyle info, such as hobbies, interests, grandchildren, favorite sports

You may find that a certain percentage of your prospects have new teen drivers at home (aka future new college students). Or you may find that another large group are GenXers and future beneficiaries of the great wealth transfer.

In both cases, you could discover financial advisor marketing common segments and a clearer view of your audience.

With a clear view of your target reader’s life stage, you can write through their eyes. E.g., “Pre-retirement considerations for future inheritors” can capture the attention of the correct recipients and no others.

Create prospect segments by financial advisory needs

Another communications angle can be less about a problem to solve and more about specific requirements. For example, many of your best prospects may engage you for estate planning. As mentioned above, you’ll need client segmentation data such as:

- Characteristics - being a business owner, veteran, or pre-retiree, can have unique financial needs

- Financial interests - estate planning, real estate investing, or charitable giving

Ideally, your well-crafted email about estate planning lands on the desk of someone ready for estate planning. Segmentation plays a key role.

Prospect Messaging — Measure Twice, Cut Once

Planning client and prospect communications with your audience in mind helps to drive engagement. A straightforward framework you may find useful is the ‘A-B-C-D-E’ method. It’s easy to remember and helps consider communication from end-to-end, including defining success.

- Audience: Who is your target audience, and why are you targeting them?

- Behavior: What behavior do you want to happen? What is the call to action?

- Content: What content is needed to achieve the desired behavior? WIFM.

- Delivery: What is the suitable medium? Email? Webinar? Pre-recorded video?

- Evaluation: What are the KPIs? Open rate, click-through, meetings, new AUM?

Example ABCDE

|

Audience: |

Business owners that are getting ready to sell and retire |

|

Behavior: |

Learn more about your firm and how you have helped other business owners create a smooth transition to a comfortable retirement. CTA: Schedule an initial consultation |

|

Content: |

Articles that highlight your experience and expertise with specific tips that business owners can leverage now to set themselves and their families up for the next phase. |

|

Delivery: |

Blog posts with social promotion with email collection |

|

Evaluation: |

|

An outline helps keep the content on target with its goals and success metrics. The time savings from planning before writing can be profound.

Learn More About Your Clients and Prospects

Tell. Don’t Sell.

Use some tried and true storytelling techniques to make messaging more exciting and engaging. Establish your prospect as the story’s hero, empathizing with their situation and needs. Rather than focusing your messages on what you do, focus on what your prospects do, their needs, and their concerns. What happens to people who don’t have someone like you to help guide them? What can happen if they don’t have someone like you advising them?

Where you can, show examples of how you helped guide others through challenging financial decisions. Be clear with your audience about different approaches. Present yourself as a trusted resource with anecdotes about unique needs that you have helped address. This may help others relate and realize that you have been there and have the experience they are looking for.

The more you can take this mindset into your writing, seeing financial planning concerns through the eyes of your clients and prospects. Engagement is likely to follow.

Prospect Messaging Matters

Your email messaging, topics, and tone can all play a role in successful communications.

Even more critical is writing with your desired audience clearly defined. Who are they and what are their financial needs?

Your clients and prospects have limited time to engage with your marketing messages, so when you catch their attention, you need it to count—the more targeted your communications, the better. Before you craft new client and prospect communications, consider your prospects and clients as much as possible. What do they have in common? How might you segment them into smaller groups so that your messaging is hyper targeted. Aim to reach the right audiences with the right messages to grow your practice profitably.

1063249.1.0