This post originally appeared on Financialplanning.com

Firm leaders seek sustainable and predictable growth for their businesses, and it’s exciting to see the industry rallying around the need for innovation in the “front office”.

No matter where I turned at the 2024 T3 Conference in Las Vegas, growth was on everyone’s minds. Marketing and growth leaders were looking for tools to spur growth, and the exhibitors approached the challenge from a dozen different directions. I saw a lot of great ideas on display, and my colleagues and I congratulate Joel on T3’s 20th anniversary and the energy of the show. It’s a great forum for firms and their tech partners to compare notes on such a scale.

T3 attendees talked about growth last year, of course. But it’s like comparing a whisper to a roar. The folks I talked to left no stone unturned: organic growth, M&A, referrals, cross-selling, and custodian referral programs have all received fresh attention. Each path, while promising, comes with its own set of challenges and opportunities.

Referrals, while effective, can be difficult to scale, and I heard frustration coming from how unpredictable they can be. M&A comes and goes in long cycles. It takes a lot of time, capital and momentum for firms to approach the deal table. Custodial referral and cross-selling programs were seen as limited in scope to the firms who participate in them. We debated the merits and drawbacks of each potential pathway to growth. But upon reflection (and the benefit of a long flight back to Boston), I realized what everyone really wants - and no one can easily produce - is consistency and scalability.

So why is consistent growth so difficult? I think that the key is building a robust organic growth program which supports all other available paths to adding AUM. It requires an investment in time and resources. But if done right, it can be the most scalable and cost-effective way to improve conversions on lead gen, boost referral success, and maximize the impact of M&A.

An organic growth process begins with creating a pipeline of high-quality leads that eventually transform into strong prospects and, ultimately, solid clients. Strategies for building this pipeline vary, involving a mix of digital and analog marketing, collaborations with lead generation providers, and traditional in-person networking.

However, one of the real challenge lies in the next phase: qualifying these leads. I heard that firms struggle here due to resource limitations or inefficient workflows. The process of lead qualification is critical and often undervalued. Firms must prioritize and invest in robust qualification processes to guard against chasing false leads. Implementing a growth platform can help alleviate that pain point while also helping drive new AUM via proactive marketing campaigns.

Next comes the art of the pitch and the close. There seems to be a lack of alignment between the pitch and the prospects' needs, a subtle yet powerful shift from selling what you have to providing what they need. This is an area ripe for improvement, as I hear firms are still figuring out the best approaches to convert prospects into clients.

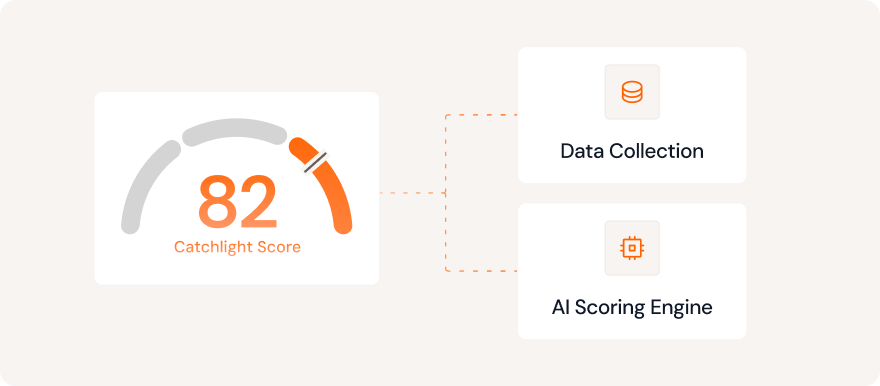

At T3, the conversations frequently turned to the role of technology in enhancing growth strategies. To drive sustainable growth, I believe firms should integrate technology throughout the customer acquisition funnel, leveraging platforms that deliver valuable data and insights. This technology should support all paths to expanding AUM. Investing in growth paths that promise predictable outcomes is akin to a wealth manager's approach to investing in assets. Data enhances every aspect of growth, from analyzing M&A targets to refining referral strategies with sophisticated modeling. The key is to find partners and vendors who are not just service providers but allies in your growth journey, offering solutions that can seamlessly integrate and elevate your existing strategies.

As we forge ahead in 2024, the mantra I am hearing from wealth management leaders is clear: They desire organic growth and are pushing their teams to embrace the power of data and leverage technology to enhance every step of their growth strategy. By balancing traditional wisdom with innovative approaches, firms can navigate the complexities of today’s financial landscape and chart a course for sustainable, predictable growth.

Wilbur Swan, CEO & Co-founder, Catchlight