With a better process for organic growth, you could find hidden gems in your existing lead pool.

Key points:

- In the midst of a generational wealth transfer, financial advisors face an increased need to sharpen their client acquisition strategies for a competitive edge.

- To tackle the challenges posed by shifting market dynamics and the increased presence of private equity, wealth management firms require advanced tools to drive organic growth.

- Unlocking hidden revenue in high-quality prospects demands delving deeper into existing leads. This involves utilizing data-driven analytics to reveal factors such as certain demographics, estimated income, and age range. These insights can help identify and convert top potential clients.

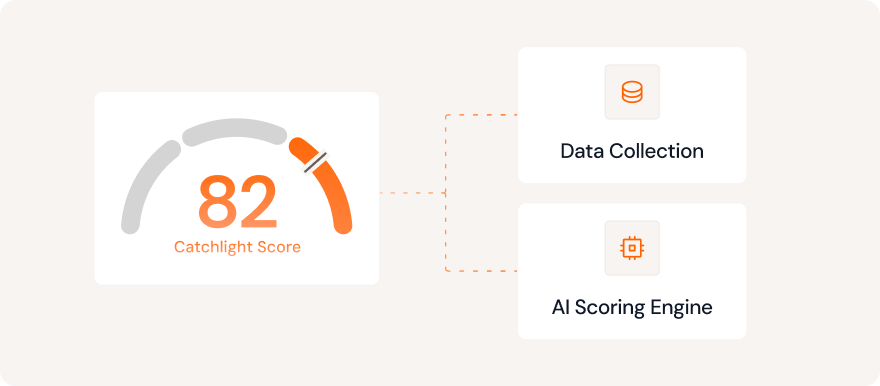

- Leveraging the power of AI technology, Catchlight examines up to 2,000 data points for each prospect. By pinpointing leads with the highest conversion potential, Catchlight can empower financial advisors by saving time and providing them with effective tools to successfully close deals.

8 minute read

Seizing the opportunity

The wealth transfer wave

As we anticipate the wealth transfer from Baby Boomers to Millennials and Gen X, it's a transformative moment for wealth management firms. Financial guidance has never been more significant, especially helping younger generations navigate newfound wealth. However, amid recent market shifts, a changing landscape, and heightened competition, the need for financial advisory firms to embrace natural growth is more crucial than ever.

Adapting to market changes and overcoming challenges

In the past 10 years, advisors rode the wave of several markets’ positive trends, but the dynamics are evolving. The conventional gains in Dow/ Nasdaq aren't as prominent, and interest rates introduce new hurdles. The surge in M&A and roll-up activities, fueled by private equity, brings added complexity. Wealth management firms now grapple with challenges like required minimum distributions affecting assets under management (AUM) and rising client acquisition costs (CAC).

Going beyond M&A: Developing a thoughtful strategy

While M&A has played a pivotal role in growth, the influx of private equity suggests that wealth management firms should explore alternative avenues. Merely generating leads and passing them on to advisors or business development representatives falls short for reliable organic growth. Go-to-market leaders, who already juggle various priorities like corporate marketing and acquisition-channel optimization, may require a more efficient strategy for qualifying and converting prospects.

Unlocking potential within your CRM

The key doesn't just lie in consistently generating high-quality leads, but also in optimizing the existing leads within your CRM. The resources to acquire these prospects have already been invested, making it crucial to shift focus to efficiently qualify and convert them. This approach may allow firms to discover hidden revenue within their current pipeline.

Your firm’s CRM is filled with leads gathered from various sources. Instead of advisors or marketing teams constantly chasing new leads, you can shift your focus to uncovering the hidden potential within the leads you already have. Let’s then take a closer look at how your firm is qualifying these leads, making sure it lines up with the unique needs and financial dreams of potential clients.

Ways to fine-tune your process

Better lead qualification: To polish up your lead qualification process to make sure it's a strong match with your ideal client profile, use data analytics and customer insights to spot commonalities among your top clients, and then apply these lessons to your existing leads.

Bring in AI-powered tech to thoroughly analyze your list of potential clients. Pinpoint the prospects who are more likely to convert by considering factors like interests, demographics, career details, and more. This approach not only saves time but also helps amp up the effectiveness of your conversion efforts.

More personalization: Provide a better experience for your prospects by adding more personalization. It’s no secret that personalization can help increase conversion, but you need powerful data leveraged effectively for maximum impact. For example, if a business owner is a few years away from retirement, now is the time to talk about strategies for exiting or selling their business. The data needed to build a personalized message can be very hard to source without a trusted partner.

Steering your firm in the right direction

When it comes to growing for the long haul, us folks in wealth management need to spice things up a bit. It's not just about generating more leads; it's about squeezing every bit of opportunity from the leads already in your basket. Picture it like giving your trusted old recipe a modern twist – by embracing lead optimization systems and riding the tech wave, you can help set up your firm for success.

A realistic scenario: A close-up look at your leads

Meet XYZ firm, the heavyweight champ in wealth management, pulling in a cool 50,000 leads each year. But here's the inside scoop: there's a golden opportunity to optimize how these leads are taken care of. Due to some capacity limitations, only half of these leads (25,000) are getting attention from the XYZ advisors. Time to turn those leads into lifelong relationships!

The average AUM is $1million with fees at 0.9%. Most leads are basic form fills, giving essential info like name, email, phone number, and, in some cases, self-reported household income or estimated savings.

The current approach involves sending these leads to advisors without a solid scoring system. Advisors split their effort equally across all leads, missing the point that not all leads have an equal shot at converting. To work smarter, XYZ firm categorizes leads into three groups: high chance (30%), medium chance (50%), and low chance (20%).

A significant shift is proposed...

Instead of distributing efforts in proportion to lead generation, XYZ firm should aim to concentrate resources where the conversion probability is highest. By focusing 45% of calls on the 30% of high chance leads and allocating only 5% of calls to the bottom 20% of leads, the firm could potentially close 19 more clients, resulting in an additional $168,750 in revenue.

Turning things up a notch by adding a personal touch

So, boosting conversion rates isn't rocket science; it's about making our marketing strategies more refined and getting up close and personal with our prospects.

Enter the magic wand: personalization.

All things being equal, even a slight 0.1% uptick in conversion rates can have a significant impact. For those high-chance and medium-chance leads, XYZ firm could welcome 24 more clients, bringing in an extra $213,750 in revenue if its conversion rate increased by 0.1% through personalization.

Consider this: Advisors invest 5 minutes researching each lead before dialing the phone. That sums up to over 2,000 hours each year for the entire team. Picture redirecting that time – not just for the sake of dollars, but to enhance the client experience or to connect with those outstanding leads. It's about advisors playing to their strengths, making every moment count in the most meaningful way.

And, while making a great first connection is essential, firms need to grasp the concept that it's a journey. It's not just about reeling in leads; it's about becoming the reliable guide that smoothly navigates them toward conversion. It’s about building something lasting.

The secret sauce

Catchlight’s AI-powered platform is like the secret sauce you didn't know you needed. We're not just skimming the surface; we're diving deep into your existing leads. Catchlight can help your firm discover and convert your best leads – aligning with the goals we've discussed.

We can help make your advisors and marketing team more efficient. Our models use data from 200,000 past investor and advisor interactions to tell you which leads are most likely to seal the deal. We provide information, like estimated income range, liquid investable assets, age range, and life events. Armed with this info, your team can create a personalized approach to help boost conversions.

Interested to learn how Catchlight.ai can help you build an organic growth engine? Book a strategy call with our team.

1127993.1.0