Importance of Prospecting for Financial Advisors

Generating growth in new AUM is generally a key goal for an RIA, with the average financial advisor spending upwards of a day per week pursuing new clients. And it’s tough.

When it comes to High Net Worth Individuals (HNWIs) and Ultra High Net Individuals (UHNWIs), the # of prospects is finite, thus the competition to attract and win those clients can be fierce. In fact, the number of UHNWIs is a fraction of the number of RIAs.

Efficiently targeting prospects can be a challenge.

For every financial advisory office, hundreds of people have over $1 million in assets. But RIA prospecting can be expensive. According to a 2021 survey by Kitces, client acquisition costs are $3,119 on average (mainly the cost of time, not cash), and it can take 3+ years to earn it back. So prospecting improvements can profoundly impact profitability. Suppose you can attract the same number of new customers from half as many prospects. In that case, your customer acquisition cost could decline by 50%. You may also be able to achieve break-even profitability in half the time.

You can spend less time and energy getting similar results by segmenting and prioritizing leads.

Prospecting for wealth management clients is hard work.

According to Investopedia, people often become Financial Advisors because of the significant earning potential, a flexible work schedule, and the ability to tailor their practice. The downsides include high stress and the hard work needed to build a client base. Prospecting is central to your business, and as you compete with almost 115,000 (per: https://www.sec.gov/help/foiadocsinvafoia) other RIA offices, one can expect that those who work smartest may have an advantage.

To work smart, you’ll need to do some upfront planning.

Financial Advisor Prospecting — Before You Start

We suggest developing a clear set of overall prospecting goals from both bottom-up and top-down perspectives.

Your tactics, i.e., how you’ll achieve these goals, will be driven significantly by your segmentation.

Establish Clear Financial Advisor Prospecting Goals

How many new clients do you wish to attract during the next 12 months? And how many prospects will you need to achieve your goal? It’s a guessing game unless you have data from experience. Depending on the objective, you may focus more on multi-prospect events, or you may focus more on one-on-one conversations. To plan, look to the past. What activities have delivered the most prospects, and which have yielded new clients? Consider that they may be two entirely different activities. Also, consider the lifetime value of those new clients relative to your acquisition efforts.

For illustrative purposes.

For illustrative purposes.

Financial Advisor Segmentation

Our recent blog post explains how client segmentation helps financial advisors focus time and energy on people more

likely to become clients. In summary:

-

Step 1: Define your ideal clients. Decide which prospects match up best with your expertise and preferred investable assets.

-

Step 2: Enrich your prospect information. Add demographic, psychographic, geographic, and behavioral data.

-

Step 3: Find common characteristics. E.g., age, life stage, profession, job changes, stock grants, and children’s ages.

-

Step 4: Define your target segments. Create a segment or segments with similar attributes.

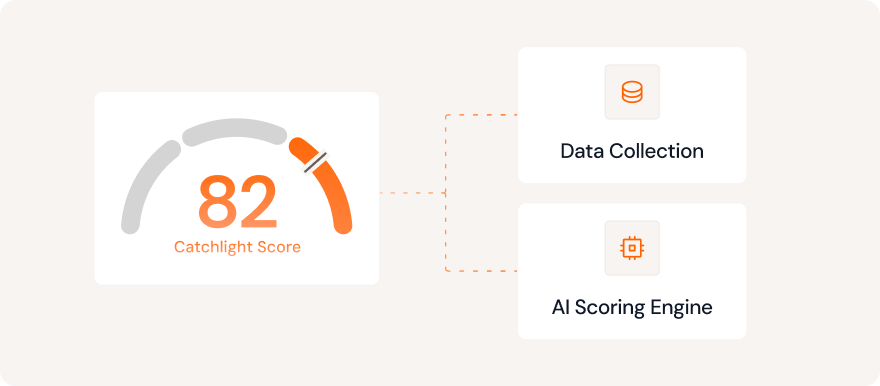

Number 2 is often the most critical segmentation step because you can only know so much about your prospects. How do you know which prospects are most likely to become clients? Fortunately, solutions exist today to score your leads and identify the best opportunities.

Prospecting Ideas for Financial Advisors

Your prospecting approach will likely differ depending on your segmentation and targeting. Still, each of the following prospecting ideas may successfully attract your ideal prospects.

Prospecting Idea #1: Invite prospects to a client appreciation event

One of the best ways to demonstrate your stellar customer service is for your prospects to hear directly from your clients. In our recent Financial Advisor marketing post, we explored this in depth.

Plan an event geared towards your clients’ interests based on the segmentation work you’ve done in step 2 above.

For example, if your clientele includes art enthusiasts, hold a cocktail event in a local gallery. Are they food & wine fans? Book a private room at a local restaurant that offers unique dining options. A Catchlight customer did an event at a local vineyard, and it was a massive hit.

Consider letting your current clients do some prospecting for you. Their conversations with potential clients can give prospects the social proof they need to trust you with their hard-earned assets.

Your goal is to maximize time with prospects, so make sure you put together events they will remember because you planned with their interests in mind.

Pro tip #1: Let your prospects bring a +1. This may increase attendance and generate more potential referrals.

Pro tip #2: Make it as convenient to attend as possible, considering school holidays, timing, and parking.

Pro tip #3: Follow up, thanking your attendees and offering additional information

And bring some of the marketing materials we recommended in our recent post on financial advisor growth marketing strategies.

Prospecting Idea #2: Support your clients’ (and prospects’) charities

Your segmentation efforts can help you understand where your prospects’ interests are most concentrated– including community involvement. Joining community activities can build your social currency and create real personal bonds. If your prospects, or those who interact with them, get to know you personally, you can be well positioned as a trusted advisor.

Pro tip: Host a charity event that will benefit the community – pick a charity that you know aligns with many of your clients' interests as well as your own. Your clients may even invite additional potential prospects that are a great fit for your firm.

Also, make sure you’re aware of fundraisers that your prospects are hosting. For the price of one ticket, attend, and you’ll show you care about that prospect and share common interests. You’ll also gain access to other prospects at the event, some of whom may be a perfect fit for your practice.

And don’t forget, it’s not just the adults’ charities that matter. Your prospects may have children that are involved in local charities or non-profit groups. Sponsoring a local youth sports team is a great way to build awareness for your firm.

Prospecting Idea #3: Leverage social media for prospecting

Social media can provide many windows into your clients' and prospects' personal and professional lives. Social media can also give them a window into your expertise, hobbies, and integrity. Even if you’re uncomfortable posting, you can support your clients and prospects to deepen your connections with passive engagement.

Follow your clients and prospects on social media.

One easy way to engage with your prospects is to follow them on social media and networking sites such as LinkedIn, Twitter, Facebook, and Instagram. You’ll have a steady stream of opportunities to show your support, deepen connections, and keep yourself top of mind.

Pro Tip #1: Comment, comment, comment!

Engage social posts from your prospects and clients. ‘Likes’ help, but words can help create more meaningful connections with your potential clients on their terms and topics of their interest. Doing this can help build trust over time.

Pro Tip #2: Share posts highlighting your expertise, personality, and values.

Each social platform has its quirks. When posting, recognize that:

-

LinkedIn is a professional network, so it’s best to stay in the “professional expertise” lane.

-

Facebook and Instagram are great for sharing your personality but tend to be less work-oriented.

-

Twitter is in-between, with a broad mixture of user types and commentary.

You can gain social proof if one of your clients or prospects likes or shares your posts. Over time, the effects can build. Keep it fun and learn more in our recent Financial Advisor social media marketing post.

Lastly, social media is a long-term solution. Recency and frequency play an essential role in a social media strategy. Posting a few times per week can help keep you present in your followers’ feeds. Consistency is key. And remember, each post does not have to be earth-shattering.

Prospecting Idea #4: Go Vertical and Prospect Your Family Trees

You’ve met the parents. Now meet the kids. If your clients trust you, their children are likely to as well. Start with your clients who are grandparents. Some successful techniques to continue your family relationship across generations include:

-

Offer a family meeting to help the parents and grown-up kids. You can suggest that your clients include their kids in a portfolio review so they can learn about your decision-making and estate-planning priorities.

-

Consider offering free or discounted services to family members. Develop trust now with an eye toward the future. You can aim to be their trusted advisor when family wealth is transferred between generations.

These conversations give your clients a chance to explain their wishes for the likely transfer of wealth. For example, how will an estate be shared in families with divorced parents who have remarried or who will care for an aging relative? Some of your clients have yet to have these conversations with their families.

Pro Tip #1: Ask your client to come to the table with an inventory of assets and documents and where to find them (e.g., a rare coin collection).

Pro Tip #2: Act as a facilitator, manage the meeting agenda, and listen carefully.

Pro Tip #3: Follow up on everything. Perhaps one of your clients’ children recently started a new job, and you can help set up a retirement account.

By meeting with the family, you can aim to establish yourself as the entire brood’s de facto financial advisor. You can position yourself to become the first person they’ll all call when the need arises. And, you will have opened the channel for you to share information that may help them all on their financial journeys.

Learn More About Your Prospects Today

The first step on your next prospecting journey is to segment your leads. Let’s get started!

1066538.1.0