The Growth Imperative

A leading source of new business for advisory firms continues to be referrals. However, in the current day, traditional referral activities are not always enough to make up for client churn or the assets lost when clients take money out for retirement. Advisors need to prioritize rediscovering and rebuilding their marketing muscles.

How you are producing content that showcases how your firm solves real-world financial planning and investing problems is especially important now that consumers are engaging and searching more for service professionals through online and social media channels.

Key questions to focus on:

- How are you positioned in the marketplace?

- Who is your ideal client and how are you proactively engaging?

In our latest whitepaper we cover 5 steps to creating an organic growth engine. From a clearly defined strategy through onboarding a new client, the whitepaper outlines how to drive growth in your firm. We also highlight a few advisors who have developed their own growth engines – and share how they focus on growth.

Read on for a few highlights and download the entire white paper here.

1. Developing your strategy

The addressable market for financial advisors is massive with representation of over $64 trillion in assets. Yet according to a 2023 survey of financial advisors, 57% of advisory firms had one or more leads in common. Therefore, defining your target market, and then your ideal customer profile, makes it much easier to deliver clear and compelling positioning of your firm. You can stand out from the crowd when you speak to those you specifically seek.

Many advisory firms lack million-dollar advertising budgets and are not participating in custodial referral programs, so instead, they need to mine today’s digital channels for client acquisition to get scale and achieve an ROI.

According to Gary Foodim*, CMO for Mercer Advisors, a $40+ billion RIA, marketing opportunities for advisors can take the form of

- paid search ads in search engines

- paid social media placements

- etc.

These advertisements need to have a clear “call to action”, or CTA, to engage with your content so that you can gather their contact information and put them into your sales funnel.

2. Lead generation

Many advisory firms lack million-dollar advertising budgets and are not participating in custodial referral programs, so instead, they need to mine today’s digital channels for client acquisition to get scale and achieve an ROI.According to Gary Foodim*, CMO for Mercer Advisors, a $40+ billion RIA, marketing opportunities for advisors can take the form of

- paid search ads in search engines

- paid social media placements

- etc.

These advertisements need to have a clear “call to action”, or CTA, to engage with your content so that you can gather their contact information and put them into your sales funnel.

Download the Creating a Sustainable Business Report Today

Get an in-depth look at:

- Criteria for defining your target market and ideal customer profile

- More info on marketing opportunities and CTAs

- Examples of “drip” activities and technologies for lead nurturing

- How to better prepare for meeting with prospects

- Information on advisor growth programs

- How Catchlight can support you through each step

- And more!

3. Lead Nurturing

Once you have built out your database of prospects who have responded to your lead generation activities, it is important to continue to communicate with them to keep your firm top of mind.

These prospects are then considered “warm” leads and in order to further engage with that interest, it is wise to invest in those leads through ongoing communications.

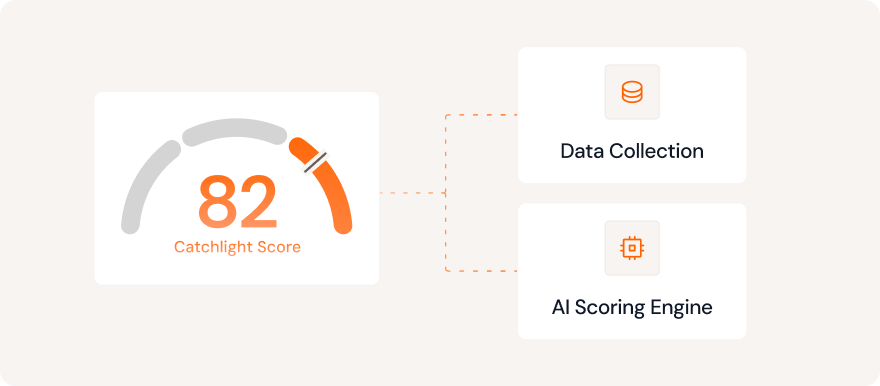

Catchlight’s new AI technology can then help generate personalized nurturing emails to enhance your lead conversion processes.

4. Internal Sales Follow-Up

A critical component of organic growth can be developing an internal resource that can follow up and help close leads. Someone on your team can be dedicated to this with a portion of their role to call leads quickly, qualify them, vector to the appropriate advisor that works well with their situation, and help close the business.

Leads who proactively reach out to you may be high-quality and if they aren’t followed up immediately, they could quickly lose interest and move on.

5. Onboarding

It is often in this final stage of the process that any mishaps give the prospect a reason for not following through. As such, it should be managed and prioritized appropriately.

Even the most powerful lead generation systems can’t replace the human-to-human interaction at the final point of sale. Thus, advisor education programs can be critical to cementing the deal as these prospects will likely go online to research that advisor to confirm their purchase decision.

Download the whitepaper to learn more

Advisors have the potential to build their growth engine faster with the help of the steps above. Dive into a more in-depth look at this step-by-step guide within the full article. Additionally, Tim Welsh, CEO of Nexus Strategy, sat down with 4 top advisory firms. These interviews are included within the full version of the paper as they detail insights and approaches to expanding your business.

Take your growth to new heights and download the full paper below.

* Now More Than Ever, Advisors Need A Marketing Makeover

The Organic Growth Imperative for Today's Financial Advisor

The Growth Imperative

A leading source of new business for advisory firms continues to be referrals. However, in the current day, traditional referral activities are not always enough to make up for client churn or the assets lost when clients take money out for retirement. Advisors need to prioritize rediscovering and rebuilding their marketing muscles.

How you are producing content that showcases how your firm solves real-world financial planning and investing problems is especially important now that consumers are engaging and searching more for service professionals through online and social media channels.

Key questions to focus on:

- How are you positioned in the marketplace?

- Who is your ideal client and how are you proactively engaging?

In our latest whitepaper we cover 5 steps to creating an organic growth engine. From a clearly defined strategy through onboarding a new client, the whitepaper outlines how to drive growth in your firm. We also highlight a few advisors who have developed their own growth engines – and share how they focus on growth.

Read on for a few highlights and download the entire white paper here.

1. Developing your strategy

The addressable market for financial advisors is massive with representation of over $64 trillion in assets. Yet according to a 2023 survey of financial advisors, 57% of advisory firms had one or more leads in common. Therefore, defining your target market, and then your ideal customer profile, makes it much easier to deliver clear and compelling positioning of your firm. You can stand out from the crowd when you speak to those you specifically seek.

Many advisory firms lack million-dollar advertising budgets and are not participating in custodial referral programs, so instead, they need to mine today’s digital channels for client acquisition to get scale and achieve an ROI.

According to Gary Foodim*, CMO for Mercer Advisors, a $40+ billion RIA, marketing opportunities for advisors can take the form of

- paid search ads in search engines

- paid social media placements

- etc.

These advertisements need to have a clear “call to action”, or CTA, to engage with your content so that you can gather their contact information and put them into your sales funnel.

2. Lead generation

Many advisory firms lack million-dollar advertising budgets and are not participating in custodial referral programs, so instead, they need to mine today’s digital channels for client acquisition to get scale and achieve an ROI.According to Gary Foodim*, CMO for Mercer Advisors, a $40+ billion RIA, marketing opportunities for advisors can take the form of

- paid search ads in search engines

- paid social media placements

- etc.

These advertisements need to have a clear “call to action”, or CTA, to engage with your content so that you can gather their contact information and put them into your sales funnel.

Download the Creating a Sustainable Business Report Today

Get an in-depth look at:

- Criteria for defining your target market and ideal customer profile

- More info on marketing opportunities and CTAs

- Examples of “drip” activities and technologies for lead nurturing

- How to better prepare for meeting with prospects

- Information on advisor growth programs

- How Catchlight can support you through each step

- And more!

3. Lead Nurturing

Once you have built out your database of prospects who have responded to your lead generation activities, it is important to continue to communicate with them to keep your firm top of mind.

These prospects are then considered “warm” leads and in order to further engage with that interest, it is wise to invest in those leads through ongoing communications.

Catchlight’s new AI technology can then help generate personalized nurturing emails to enhance your lead conversion processes.

4. Internal Sales Follow-Up

A critical component of organic growth can be developing an internal resource that can follow up and help close leads. Someone on your team can be dedicated to this with a portion of their role to call leads quickly, qualify them, vector to the appropriate advisor that works well with their situation, and help close the business.

Leads who proactively reach out to you may be high-quality and if they aren’t followed up immediately, they could quickly lose interest and move on.

5. Onboarding

It is often in this final stage of the process that any mishaps give the prospect a reason for not following through. As such, it should be managed and prioritized appropriately.

Even the most powerful lead generation systems can’t replace the human-to-human interaction at the final point of sale. Thus, advisor education programs can be critical to cementing the deal as these prospects will likely go online to research that advisor to confirm their purchase decision.

Download the whitepaper to learn more

Advisors have the potential to build their growth engine faster with the help of the steps above. Dive into a more in-depth look at this step-by-step guide within the full article. Additionally, Tim Welsh, CEO of Nexus Strategy, sat down with 4 top advisory firms. These interviews are included within the full version of the paper as they detail insights and approaches to expanding your business.

Take your growth to new heights and download the full paper below.

* Now More Than Ever, Advisors Need A Marketing Makeover

Topics: Blog, Organic Growth